Overview of U.S.-Iran Tensions and Recent Events

The relationship between the United States and Iran has historically been fraught with conflict, rooted in a complex web of geopolitical interests, historical grievances, and ideological strife. The tensions have escalated dramatically in recent years, particularly following the U.S. withdrawal from the Joint Comprehensive Plan of Action (JCPOA) in May 2018. This pivotal decision sparked a series of events that fueled animosity between the two nations. Iran’s subsequent advancements in its nuclear program and aggressive regional maneuvers further exacerbated the situation.

Key incidents contributing to the current conflict include Iran’s alleged involvement in attacks on U.S. assets in the Middle East and the targeted killing of Iranian General Qassem Soleimani by a U.S. drone strike in January 2020. This assassination marked a significant turning point in U.S.-Iran relations and ignited widespread fears of escalation. Iran’s retaliatory missile strikes on U.S. bases in Iraq showcased the rapid divergence from diplomatic engagement towards direct military confrontation.

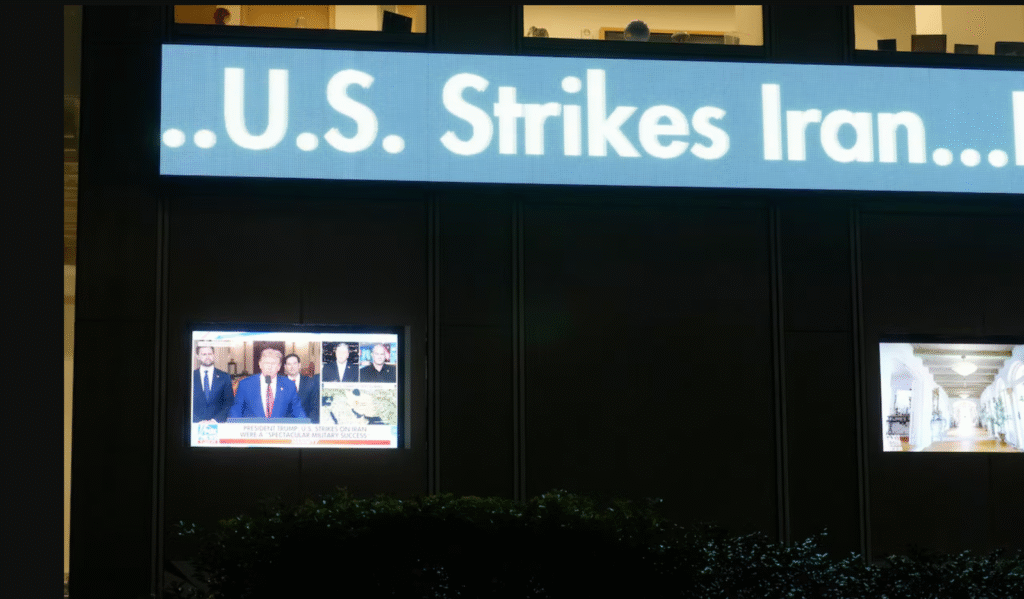

The recent U.S. airstrikes on Iranian nuclear sites have heightened these tensions even further. President Trump characterized the military action as a ‘spectacular military success,’ framing it as a necessary response to perceived threats stemming from Iran’s nuclear ambitions. This rhetoric not only reflects the administration’s hardline stance against Iran but also fits within a broader narrative aimed at diminishing Iran’s influence in the region. The implications of these military operations extend beyond immediate regional dynamics, potentially affecting global oil prices and energy markets, as investors brace for the volatility that such conflict can provoke.

Amidst this backdrop, it is essential to understand how both nations perceive their strategic interests and the resulting actions they take. The intricate balance of power in the Middle East remains as precarious as ever, underscoring the critical relevance of diplomatic efforts amidst military provocations.

Impact on Oil Prices and Global Markets

The recent U.S. military action targeting Iran’s nuclear facilities has rekindled concerns surrounding global oil prices, which are inherently sensitive to geopolitical tensions. Historically, military conflicts have been closely correlated with fluctuations in oil prices, often leading to significant increases as supply concerns rise amid instability. In the wake of these events, market analysts and experts are predicting a potential spike in oil prices, particularly in the immediate term. The fear of supply disruptions from Iran—a major oil producer in the Middle East—could push prices significantly higher, affecting both regional and global markets.

Various studies indicate that oil prices frequently experience volatility during geopolitical crises. For instance, prior conflicts involving oil-rich nations have typically led to sharp increases in crude oil prices, as fear over supply disruptions drives speculation. As investors brace for such scenarios, they closely monitor market indicators and geopolitical developments, preparing for potential price spikes. Experts are also weighing in on the long-term implications, suggesting that stability in oil prices may be contingent on the resolution of these tensions. If military actions persist, the long-standing relationship between conflict and oil prices could escalate further, resulting in more prolonged periods of elevated prices.

Investor Behavior: A Shift Towards Safe Havens

The recent military actions, particularly the U.S. bombing of Iran’s nuclear sites, have triggered significant shifts in investor behavior, with many now gravitating towards safe-haven assets. Historical trends indicate that geopolitical tensions often lead investors to seek more secure investments to shield their wealth from potential volatility in the financial markets. This inclination towards safety manifests in stronger demand for traditional safe-haven options such as gold and U.S. Treasury bonds.

Gold, widely recognized as a hedge against economic instability, tends to appreciate in value during periods of heightened uncertainty. As tensions escalate, investors flock to gold, perceiving it as a reliable protection against inflation and currency devaluation. The historical performance of gold during crises supports this trend, as it often retains or increases its worth when other assets falter. Consequently, many investors are redistributing their portfolios to increase their holdings in gold, aligning their strategies with the prevailing market sentiment that favors lower-risk investments amidst global unease.

Similarly, U.S. Treasury bonds have emerged as another attractive option for investors in these tumultuous times. The government’s backing of these bonds, coupled with their status as a low-risk investment, makes them particularly appealing when geopolitical tensions rise. Investors rationalize that Treasury bonds will provide steady returns, even if they are lower compared to stocks or higher-yielding assets. This shift in focus also reflects a broader risk-averse strategy that investors adopt in uncertain environments, as they seek to preserve capital while navigating the complexities of emerging market investments that may carry heightened risks.

In the current climate, the rush towards safe-haven assets illustrates a marked change in investor behavior, emphasizing the importance of adapting strategies to mitigate potential risks associated with geopolitical instability. This prudent approach is essential for safeguarding investments during uncertain times, indicating that investor confidence can fluctuate significantly in response to evolving global conditions.

Future Considerations and Geopolitical Risks

The geopolitical landscape surrounding the U.S.-Iran conflict has grown increasingly complex in recent years, particularly following the recent military actions in the region. As investors contemplate the implications of the U.S. bombing of Iran’s nuclear sites, it is imperative to consider the potential future developments and their impact on global economic stability. One key concern is the likelihood of retaliatory actions from Iran, which could manifest in various forms, ranging from cyberattacks to direct military engagement against U.S. interests or allies. Such actions could exacerbate existing tensions and lead to further destabilization in the region.

Additionally, it is essential to analyze the response of other world powers, including European nations and Russia, who may seek to mediate or intervene in the conflict. Their actions could significantly influence international relations and trade agreements. In the event that military actions escalate, the United States may also face pressures from both domestic and international fronts regarding its strategic decisions. These geopolitical risks necessitate a thorough understanding of the potential ramifications on energy markets, particularly with regard to oil prices, which may experience upward pressure in the wake of heightened conflicts.

The ripple effects of prolonged tensions between the U.S. and Iran could further impact international trade, limit market access for specific commodities, and challenge supply chains globally. As such, investors are encouraged to remain vigilant, continuously assess their portfolios, and consider diversifying their investments to mitigate exposure to these geopolitical risks. Staying informed about potential developments in the region will be essential for adapting investment strategies and maintaining portfolio resilience amidst uncertainty in energy markets and broader economic conditions.